Renewable generation from wind and solar power has increased substantially in recent years, and the pace may well accelerate under the Biden administration’s goal of decarbonizing the electricity grid by 2035. At the same time, February’s extreme winter storm that strained the power system in the country’s central states highlighted the critical importance of maintaining conventional dispatchable generators such as coal and natural gas plants. Although necessary to maintain the reliability of the power system, these generators face reduced operations and weak electricity market prices as their output is displaced by renewable resources, whose power is intermittent in nature. To keep these balancing generators online, it is increasingly important that the value they provide is understood and compensated through capacity markets and other market mechanisms. Before the next extreme weather event threatens grid reliability, now is the time for power market operators to revisit their market design to ensure it is sufficient to keep critical generating capacity from prematurely retiring.

Dispatchable generation needs to be maintained

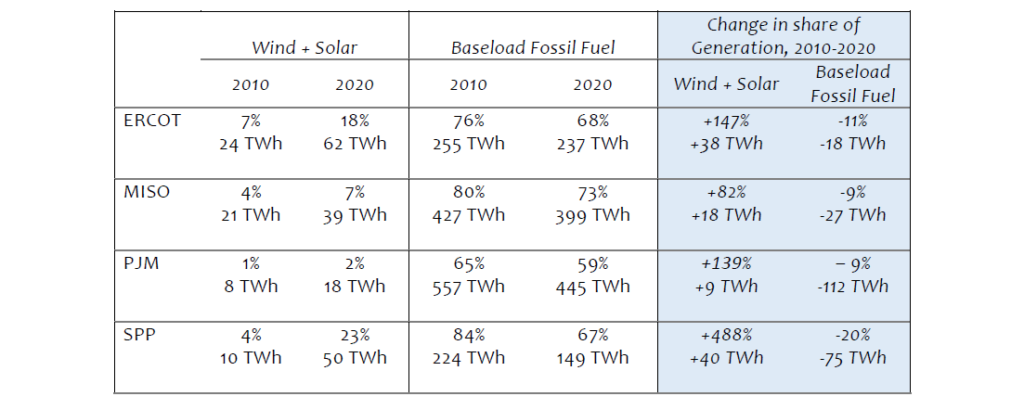

Over the last decade, renewable generators have experienced significant growth, while traditional fossil-fueled generators have seen their output decline, with many facilities opting to retire. This national trend is evident in the four largest ISO/RTO markets that have substantial amounts of renewable, natural gas, and coal generation (ERCOT, MISO, PJM, and SPP), as the tables below show.[i]

Regional share of generation, 2010-2020

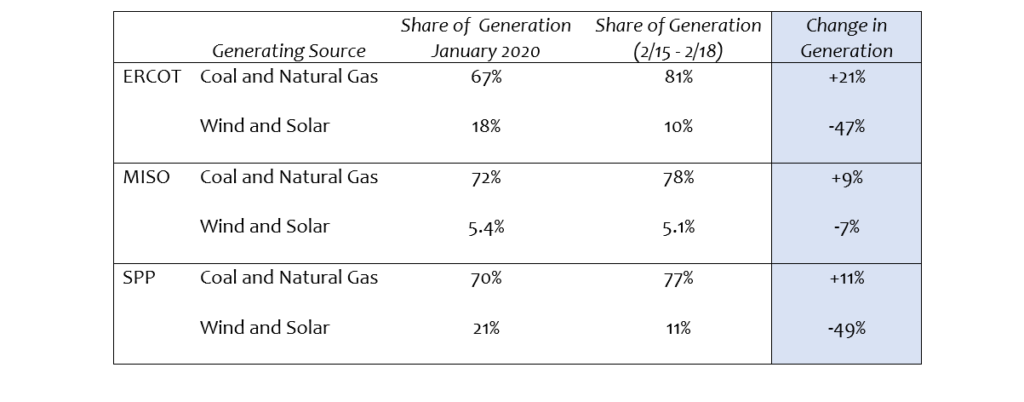

Three of these regions (ERCOT, MISO, and SPP) were subject to this year’s extreme winter storm on February 15-18. In each region, record cold temperatures led to high power demand and also caused generator outages that greatly reduced available capacity and forced the grid operator into emergency load-shedding. Despite difficult conditions, the dispatchable coal and gas generators were able to increase their collective share of electricity production by an average of 13 percent during the emergency when compared to their production a year earlier. Renewable generation production dropped by nearly half in ERCOT and SPP during the grid emergency, largely due to a lack of wind generation availability.

Performance of generators before and during 2/15 – 2/18 grid emergency[ii]

Wind generation is not always available when power demand peaks, but it is possible to maintain dispatchable generators that can step in when needed. Unfortunately, weak electricity prices have driven the recent retirement of a number of dispatchable generators in the very regions that were starved for power in February.[iii]

- In ERCOT, 5,500 MW of coal capacity and 2,900 MW of natural gas generation have retired since 2016. These total nearly 12 percent of the roughly 71,000 MW of coal and gas generation that remain online in ERCOT.

- Over 10,000 MW of coal capacity has retired in MISO since 2016, along with nearly 6,000 MW of natural gas generating capacity, which is 12 percent of the coal and gas capacity that remains.

- In SPP, nearly 3,000 MW of coal and roughly 1,300 MW of natural gas capacity has retired since 2016, or nearly 8 percent of the coal and gas capacity that remains.

Energy market prices are increasingly unable to support dispatchable generation

Unlike dispatchable generators that must burn fuel to generate power, wind and solar power incur no additional cost to generate electricity when weather permits. This allows them to offer power to the market at zero cost to ensure their output is consumed, but it also reduces market prices by displacing higher-cost resources that will no longer be setting the market price. A literature survey conducted by the Lawrence Berkeley National Laboratory found that wind and solar generation reduces electricity prices by up to $12 per MWh depending on the amount of renewables on a system and other factors, and that the price reduction increases as more renewables are added.[iv]

Lower wholesale power prices arising from wind and solar power may sound like a good deal for electricity consumers but this isn’t necessarily the case. The cost of renewables is primarily in building the facilities themselves and the associated infrastructure they require. These costs don’t show up in market electricity prices but are paid by the utilities that contract to have the wind and solar built, and through state and federal subsidies for renewable energy. Where these costs ultimately show up is in the electricity and tax bills of ratepayers.

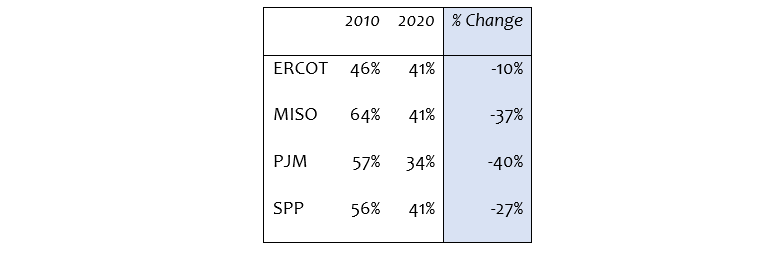

One certain result of lower wholesale market electricity prices is that dispatchable power generators will operate less frequently and earn less money when they do. The table below shows this trend, with the average capacity factor of steam turbine generators (primarily coal with some natural gas) falling between 10 and 40 percent in major power markets over the last ten years. These resources will be needed to support the reliable operation of a grid with increased penetration of intermittent renewable resources. However, without additional revenues to supplement their dwindling wholesale electricity market income, owners of these generators may opt to retire them even though doing so will decrease the reliability and resilience of the grid.

Capacity factors of steam turbine generators[v]

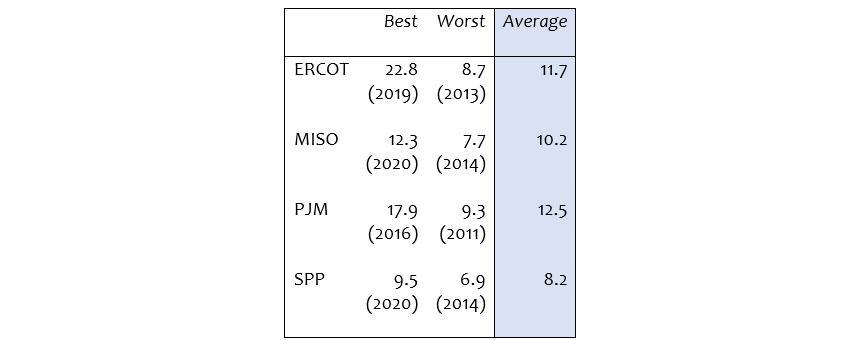

Energy consulting firm Wood Mackenzie examined electricity prices in ERCOT and found that between 2011 and 2020, there was only one year (2019) in which energy market revenues were sufficient for newly built natural gas generators to earn an adequate return on investment.[vi] This finding can also be seen in ERCOT’s “market heat rate,” which is simply the ratio of power prices to fuel prices. A higher market heat rate indicates a more profitable environment for electricity generators. While ERCOT may have had only one year in which new generating capacity earned sufficient revenues in the energy market, none of the other markets managed even a single year, as the following table shows—only PJM (in 2016) approached the results of ERCOT in 2019, but its market heat rate was still 21 percent lower. Although this shows the absence of critical energy market revenue from the perspective of natural gas generation, that missing revenue is also felt by dispatchable coal generation.

Annual average market heat rate (MMBtu/MWh) by energy market, 2011-2020[vii]

Capacity markets are growing more important

For generators that are needed to ensure reliability and resilience, the gap between the revenues received in the energy market and the revenues needed to break even financially must come from somewhere. Currently, this dilemma is dealt with differently by each ISO/RTO market. Some maintain explicit “capacity markets” that pay generators for keeping their capacity available and able to generate power when needed, regardless of whether or how much they are called on to operate (PJM). Other ISO/RTOs essentially ignore the dilemma, dangling the carrot to generators that tight market conditions might arise every few years that see power prices rise high enough to justify operating at a loss in other years (ERCOT). SPP and MISO currently occupy a middle ground in which vertically integrated utilities must procure their own capacity, with small residual capacity markets in which excesses and shortfalls in capacity are traded among utilities.

These varied approaches to paying for needed generating capacity may be converging as ISO/RTOs admit the rising need for a payment mechanism outside of energy markets to ensure that dispatchable generators remain available to support the grid. PJM is beginning to modify its capacity market rules to ensure that its prices reflect the value provided by generators (the Effective Load Carrying Capacity initiative). MISO is exploring mechanisms to enhance payments for resource adequacy. The absence of a capacity market of any kind in ERCOT is being criticized as a reason for the market’s poor performance during the February 2021 cold snap. As the saying goes, “you get what you pay for.”

The time to act is now

Two competing insights have come into clear focus in recent weeks. The first is that the Biden administration aims to accelerate the transition of the power grid to a low-carbon renewables-dominated system, which will reduce wholesale electricity prices and cause significant financial strain on the remaining dispatchable generation. The second is that this dispatchable generation is absolutely critical to support and backstop renewable generation in order to maintain grid reliability.

We urge FERC to focus its new resource adequacy docket on capacity market design, and we implore each ISO/RTO to revisit its approach to compensating generators that must remain operational to maintain reliability, either through a capacity market or similar payment. This process should include identifying the capabilities needed from other generators to maintain reliability as the grid grows more reliant on intermittent renewable generation, and determining how to value and compensate these capabilities through market mechanisms. It should incorporate lessons learned from recent grid emergencies, and consider the importance of fuel diversity and fuel security in maintaining a reliable electricity system.

[i] Data from S&P Global Insight service, queried March 10, 2021.

[ii] Generation data queried from each ISO’s website.

[iii] Energy Information Administration, Preliminary Monthly Generator Report for December 2020, February 24, 2021.

[iv] Lawrence Berkeley National Laboratory, Impact of Wind, Solar, and Other Factors on Wholesale Power Prices, November 2019.

[v] Data from S&P Global Insight service, queried March 10, 2021.

[vi] Wood Mackenzie, Texas Grid Failure and Implications for the Energy Transition, March 4, 2021.

[vii] Data from S&P Global Insight service, queried March 10, 2021.