The Department of Energy’s National Energy Technology Laboratory (NETL) continues to examine the adverse impacts on consumers if more coal-fired electric generating units retire. (More than 40% of the nation’s fleet of coal-fired units have either retired or announced plans to retire.) NETL’s first study (“Volume 1”), released in 2018, examined the Bomb Cyclone of early 2018 and concluded that coal-fired generating units were critical to maintaining the reliability and resilience of the electricity supply during the storm.[i] A newly released follow-up study (“Volume 2”)[ii] finds that the retirement of coal-fired units leads to large increases in the price of electricity and natural gas across the footprints of four of the nation’s largest grid operators.

Bomb Cyclone —

The table below shows the percentage increase in electricity and gas prices for the four regions during the 2018 Bomb Cyclone.

| ISO-NE | PJM | NYISO | MISO | |

| Natural Gas | 1,900% | 2,200% | 2,200% | 300% |

| Electricity | 500% | 500% | 700% | 300% |

NETL notes that the retirement of coal-fired units has increased reliance on natural gas-fired generating units to meet electricity demand. Cold weather leads to higher electricity demand as well as higher gas demand for both electricity generation and space heating. These increases in demand can cause gas supply shortages and spikes in the price of natural gas.

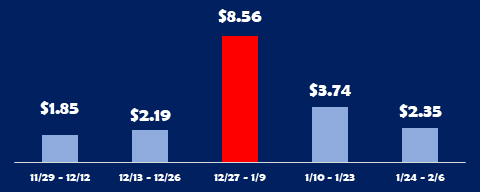

The graph below shows the total cost ($billions) consumers paid for electricity over consecutive periods before, during, and after the Bomb Cyclone.

The cost of serving electricity demand soared during the two-week period that included the Bomb Cyclone, costing $6.37 billion more than the prior two-week period and $4.82 billion more than the subsequent two-week period. Combined with the winter storms of 2014 and 2015, NETL estimates that natural gas price excursions have cost electricity ratepayers over $25 billion in these four regions since 2014. NETL does not estimate the impact of higher gas prices on residential, commercial, or industrial gas customers which comprise more than 60% of natural gas demand.

Coal Retirements —

To assess the impact of coal retirements, NETL assessed four scenarios for future winter seasons through 2024:

- Normal … uses average power demand and announced coal retirements (10.7 GW in these four market areas).

- Expected … uses extreme winter power demand,[iii] as well as announced coal retirements (10.7 GW).

- At Risk … uses extreme winter power demand and retirement of announced plus at-risk coal units (34.3 GW).

- No Retirements … uses extreme winter power demand and no future coal retirements.

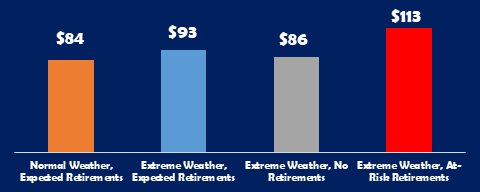

The chart below shows the total cost of electricity ($billions) under each of these scenarios.

NETL found that during the 2020-2024 winter seasons, the expected cost of electricity would increase by almost 11% ($9 billion) due to higher electricity demand during extreme winter weather. However, if weather conditions are extreme and coal retirements accelerate, electricity costs would increase by 35% ($29 billion). On the other hand, if neither announced nor at-risk coal units retired, demand during extreme weather would lead to a cost increase of only 2.5% ($2 billion).

Gas Pipelines —

NETL’s modeling also projects a need for new natural gas infrastructure (beyond projects already planned) in order to maintain reliable operation of the grid, as well as to serve other demands for natural gas. The capital costs for natural gas pipeline expansion under the four scenarios are as follows:

- With announced coal retirements of 10.7 GW, capital costs are $469 million under normal weather and $754 million under extreme weather.

- With no future retirements, the capital cost is $723 million under extreme weather.

- With announced plus at-risk retirements (34.3 GW), the capital cost is $1.07 billion under extreme weather.

These costs for gas pipelines are not included in the cost of electricity discussed above.

Conclusion —

NETL’s two-volume study

has provided compelling evidence that the nation’s coal fleet is needed to ensure

the reliability and resilience of the grid and to reduce energy costs to

consumers.

[i] NETL, “Reliability, Resilience and the Oncoming Wave of Retiring Baseload Units, Volume I: The Critical Role of Thermal Units During Extreme Weather Events,” National Energy Technology Laboratory, Pittsburgh, March 13, 2018.

[ii] The study was released in three parts, each available at https://netl.doe.gov/node/9516. All data and results cited here are sourced from these reports: NETL, “Reliability, Resilience and the Oncoming Wave of Retiring Baseload Units, Volume II-A: Case Study: Organized Markets of the Eastern Interconnection,” National Energy Technology Laboratory, Pittsburgh, April 19, 2019; NETL, “Reliability, Resilience and the Oncoming Wave of Retiring Baseload Units, Volume II-B: Electricity Generation Supply Chain in the Northeast,” National Energy Technology Laboratory, Pittsburgh, April 19, 2019; and NETL, “Reliability, Resilience and the Oncoming Wave of Retiring Baseload Units, Volume II-C: Fuel-Electricity Interaction in the Northeast and Midcontinent,” National Energy Technology Laboratory, Pittsburgh, April 19, 2019.

[iii] The high power demand modeled by NETL corresponds to the winter of 2013-2014, during which a Polar Vortex storm led to an all-time high for electricity demand in the Eastern Interconnect.