The coronavirus outbreak is doing enormous damage to major industries that are the cornerstones of the U.S. economy. One of those industries is the nation’s fleet of coal-fueled power plants that provide electricity to consumers in 47 states. During the months of March, April, May, and June, the coronavirus caused considerable economic disruption. What effect did that disruption have on the coal fleet and its supply chain?

To answer that question, we compared data from March through June 2020 to data from the same four months in 2017-2019 for PJM Interconnection (PJM), Midcontinent Independent System Operator (MISO), and Southwest Power Pool (SPP). These are electricity grid operators whose multi-state footprints encompass more than half the states and more than half the nation’s coal fleet. We picked a three-year period to avoid having one unusual year bias the comparison. Below is a summary of what we found when we compared the two time periods.

Electricity demand dropped.

PJM, MISO, and SPP are either Independent System Operators or Regional Transmission Organizations[i] (ISO/RTOs) that together cover all or part of 28 states and DC. All three ISO/RTOs maintain readily accessible databases of operational data, which show that electricity demand from March through June of this year was down 7.3% in PJM, 7.0% in MISO, and 3.3% in SPP, compared to March through June 2017-19. The combined drop was 6.6%.[ii]

Change in Electricity Demand (% and GWh)

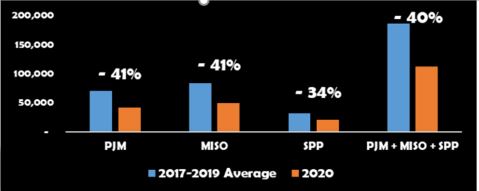

Coal-fired electricity generation fell dramatically.

PJM, MISO, and SPP have the three largest coal fleets (combined 135,000 MW) of all the grid operators. March through June 2020 electricity produced by coal dropped dramatically. Coal-fired electricity generation declined 41% in both PJM and MISO and 34% in SPP. The combined drop was nearly 40%.

Change in Coal-Fired Generation (% and GWh)

Low natural gas prices had a major effect on coal-fired generation.

The market price for coal was approximately 6% lower in March through June 2020 than March through June 2017-19. For natural gas, the decline was much more dramatic. Gas prices fell 39% nationally, 42% in PJM, and 40% in both MISO and SPP.[iii] These unusually low gas prices caused an increase in electricity generation from natural gas-fired power plants, which displaced coal-fired generation. Electricity generation from natural gas was 27% higher in PJM, 17% higher in MISO, and 6% higher in SPP.

Rail shipments of coal declined.

The vast majority of coal is shipped from mines to power plants by freight rail. In March through June 2020, these shipments fell by over 31% compared to the same period in 2019.[iv] The decline in coal shipments was the largest of any freight rail category, although coal still accounted for more than one-fourth of the rail industry’s carloads. Total freight rail carload volume in March through June 2020 declined by nearly 20%.

Sensible policies are needed.

The coal fleet and its supply chain are regarded by the Department of Homeland Security as critical infrastructure because electricity is essential to the operation of just about everything we rely on. However, coronavirus has created a new challenge for the coal fleet and its suppliers.

We need the coal fleet not only during this crisis but also when the economy recovers because it is more reliable, resilient, and fuel secure than almost any other source of electricity. In addition, the price of coal is stable, whereas the price of natural gas, a major source of electricity, often increases dramatically in the winter.

Despite these advantages, 45% of the coal fleet has retired or is expected to retire, based on announcements. Sensible policies are needed to ensure the coal fleet can continue providing electricity. For example, the Federal Energy Regulatory Commission and grid operators need to value the resilience and fuel security attributes of the coal fleet the same way essential reliability services are valued now in power markets. Public utility commissioners and decision makers should take the loss of these attributes into consideration when coal retirement decisions are being evaluated.

July 23, 2020

[i] The nine ISO/RTOs, including MISO, SPP, and PJM, were created to coordinate and administer their respective region’s wholesale electricity market and transmission network. These organizations are subject to the North American Electric Reliability Corporation (NERC) which derives its authority from the Federal Energy Regulatory Commission (FERC).

[ii] Load and generation data cited here were compiled from queries at the ISO websites, https://pjm.com/markets-and-operations/data-dictionary.aspx, https://www.misoenergy.org/markets-and-operations/real-time–market-data/market-reports, and https://marketplace.spp.org/pages/generation-mix-historical.

[iii] Market price data were queried from S&P Global Market Intelligence. Henry Hub natural gas prices are used for national prices, Chicago Citygate for MISO prices, and TETCO M3 for PJM natural gas prices.

[iv] Data were compiled from weekly freight rail traffic reports of the American Association of Railroads (weeks 10-26), available at https://www.aar.org/data-center/.