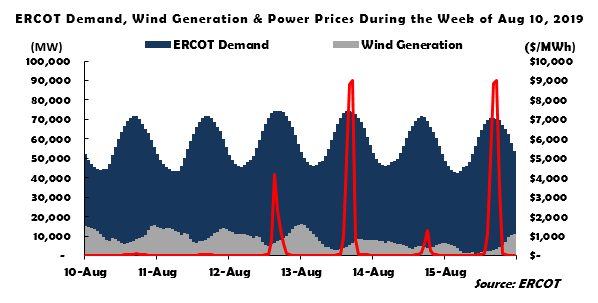

This past August, a heat wave across Texas led to record levels of electricity demand in the state, along with record-setting power prices. The worst of it came on August 13, when power prices reached the market price cap of $9,000 per megawatt-hour (MWh), roughly three hundred times higher than average. At the same time, the Electric Reliability Council of Texas (ERCOT), the state’s electricity grid operator, issued an Energy Emergency Alert and asked customers to reduce their power demand in order to avoid outages.[1]

Texas’s flirtation with power outages did not need to happen. It was prompted by an increased reliance on wind generation, the retirement of reliable coal-fired generators, and market rules that incentivize the switch from coal to wind by ignoring generator reliability.

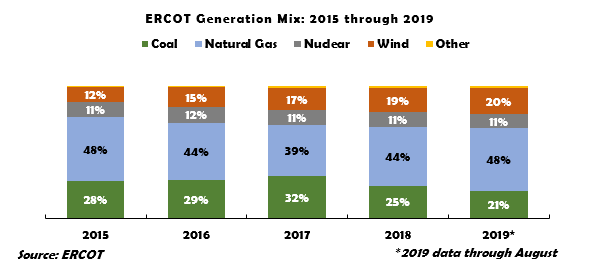

Since the end of 2014, ERCOT wind generation has almost doubled, increasing its share of total electricity generation from 12% in 2015 to 21% for the first eight months of 2019.[2] At the same time, more than 5.6 gigawatts (GW) of coal-fired generating capacity have retired, while natural gas generation has remained relatively constant over the same period.[3]

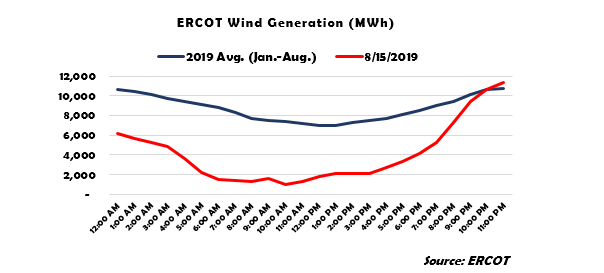

ERCOT’s peak electricity demand is usually reached during the summer months when air conditioning is at its highest. However, high temperatures also coincide with periods of low wind. Between 2016 and 2019, ERCOT’s electricity demand peaked in July and August. During peak demand hours for the same months, wind utilization rates were at their lowest all year, averaging 28.3% and 24.8%, respectively.[4] Conversely, coal-fired power plants operated at utilization rates well above 90% on average in both July and August during peak demand hours, showcasing their ability to provide electricity predictably when it is needed most.

In particular, during the record ERCOT load of August 15 when wind generation was most needed, it was least available. During the peak demand period on that day (7am to 11pm), wind turbine output was only 41% of its average generation the rest of the year. This shortfall amounted to 4,500 MW on average, a gap that could have been covered by recently retired coal units.

If the market needed these coal units, why did they retire? The answer is in the design of the market. The ERCOT market is “energy-only,” meaning the only significant source of revenue for power plants is the market price of electricity. The recent influx of tax-subsidized wind capacity has artificially suppressed these market prices to the point where many generators have been unable to earn enough revenue to continue operation. At the same time, the uncertain output of these very same wind generators demonstrates the critical importance to ERCOT of reliable backup generation—backup generation that instead was retired.

As a result of the 5.6 GW of coal retirements over the last two years, ERCOT’s summer season reserve margin – the operating “buffer” between electricity demand and available generating capacity – has dropped significantly, from 12.2% in 2017, to just 5.4% in 2019.[5] This is far below the minimum target reserve margin of 13.75% established by the ERCOT Board of Directors.”[6]

Other power markets, such as PJM, ISO New England, and New York ISO maintain “capacity markets,” which offer payments to generators for being online regardless of how often they are called on to generate electricity. Such a payment is a way to avoid the reliability risks of the ERCOT market, and ensure sufficient supply exists if it is ever needed to meet power demand. Each region with a capacity market currently has generating capacity that meets or exceeds its target reserve margin.

What the events of the week of August 12, 2019 have ultimately shown is that fossil fuel-fired generating capacity – including coal – is essential to operating a reliable electric grid during periods of peak electricity demand, when wind generation is at its low-point. However, without the proper financial incentives, more dispatchable fossil generation will exit the market, resulting in rising electric power prices, greater price volatility, and increased risk to the reliability of the electricity grid.