Almost 40 percent of the nation’s coal fleet has retired or announced plans to retire. Does it make sense to continue retiring even more coal-fired power plants? There are different ways to answer this question.

One way is to consider the dispatch cost ($/MWh) that dictates the order in which plants are dispatched at any given moment. A higher dispatch cost means a plant operates less and, therefore, its revenues are less. However, the dispatch cost includes only variable costs, such as fuel; it does not include other costs, such as maintenance and capital expenditures, which are an important consideration over a longer period of time.

A better way to answer this question is to consider the levelized cost of electricity (LCOE), which captures all of the costs (variable, fixed, capital and financing) of an electricity resource over its lifetime. A lower levelized cost is preferable to a higher levelized cost. Typically, levelized costs have been used to compare new investments. However, levelized costs are also useful to compare existing power plants to new resources.

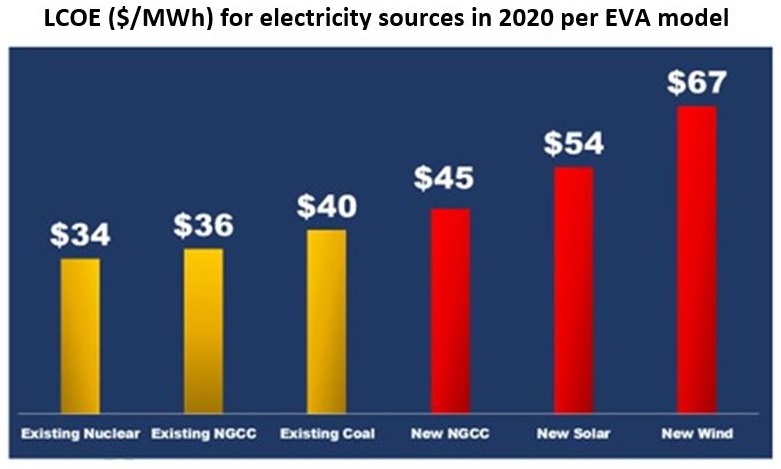

Energy Ventures Analysis (EVA) provided levelized cost estimates for various types of electricity resources.[i] We used these to compare levelized costs on a national average basis. (Levelized costs will vary from region to region and plant to plant.) The levelized cost for the average existing coal-fired power plant is less than the levelized cost for new natural gas combined cycle (NGCC), wind or solar generating capacity. To illustrate this point, the chart below compares levelized costs in 2020.

There are other considerations that could affect decisions to retire existing plants. For example, future environmental compliance costs could increase levelized costs. On the other hand, changes to wholesale market rules that value fuel security and other attributes provided by the coal fleet could reduce levelized costs.[ii] Regardless, LOCE is an important and underappreciated way to look at retirement decisions. For additional information, please see our paper at www.americaspower.org.

_____________________________________________________________________________________________________________